Trump Inauguration Brings $2.2 Billion in Crypto Funds Flow, Creates New All-time High in AUM

The post Trump Inauguration Brings $2.2 Billion in Crypto Funds Flow, Creates New All-time High in AUM appeared first on Coinpedia Fintech News

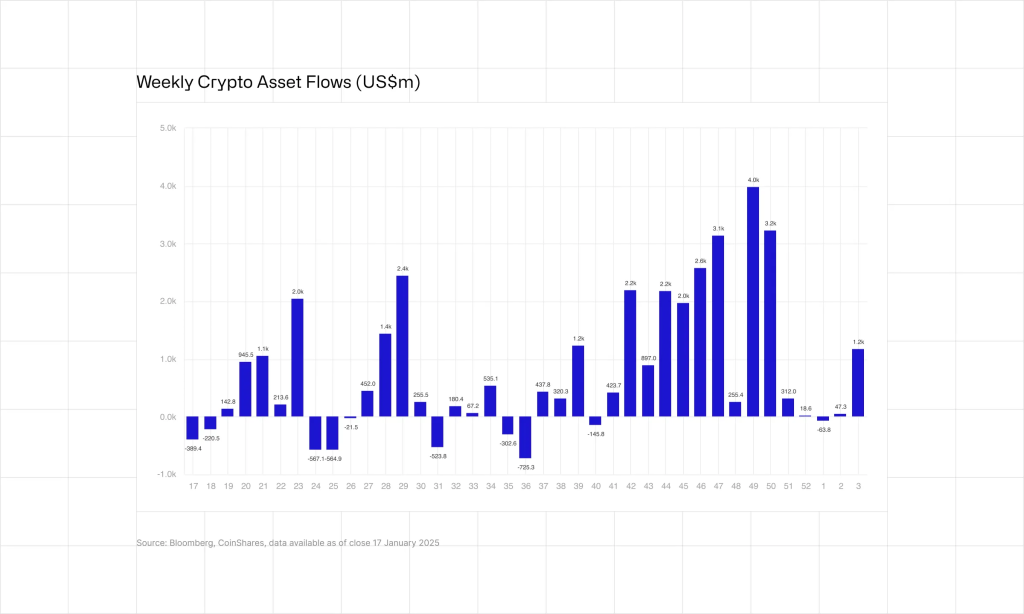

As Trump prepares for his inauguration, the crypto market keeps picking up speed. Since his election victory, dubbed the “crypto president,” Trump has been fueling the market for several months. This has led to record highs in various metrics, including a recently reached all-time high in assets under management (AUM). Moreover, the excitement surrounding the inauguration has brought a $2.2 billion inflow into crypto funds.

Trump to Start a New Era for Crypto

According to a report by CoinShares, major cryptocurrency funds managed by companies like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares saw a record $2.2 billion in net inflows last week, the highest of the year so far.

James Butterfill, the Head of Research at CoinShares, noted that these inflows were triggered by hype around Trump’s upcoming inauguration and recent positive movements in crypto prices. This surge has pushed the total assets managed by these funds to an all-time high of $171 billion.

Also read: Just In: Donald Trump Takes Oath As 47th U.S President

The majority of last week’s inflow into cryptocurrency markets originated from the U.S., which saw $2 billion funnel into various digital assets. Not far behind, Switzerland and Canada also made notable contributions, injecting $89 million and $13 million respectively into the market.

Focusing on individual cryptocurrencies, Bitcoin was a major recipient, securing $1.9 billion in new investments, increasing its annual total to $2.7 billion. Notably, there were small outflows of $0.5 million from short positions, an unusual trend given the recent uptick in its price.

Ethereum reversed previous losses by attracting $246 million in inflows, although it continues to lag behind other cryptocurrencies in terms of annual inflow. Meanwhile, Solana saw a modest increase of $2.5 million.

XRP also experienced a significant influx of $31 million last week, pushing its inflows since mid-November 2024 to $484 million. Stellar, although only seeing a slight inflow of $2.1 million, still showed positive movement. In contrast, other altcoins had minimal to no new inflows.

Trump’s Bitcoin Reserve Might Skyrocket Sentiments

The market is now expecting several executive orders supporting cryptocurrencies in the early days of the new administration, including the establishment of a Bitcoin reserve. Polymarket indicates that the chance of Trump signing an executive order to set up a Strategic Bitcoin Reserve (SBR) in his first 100 days has gone up from 44% to 55% within the last day.

The SBR would see the U.S. government acquiring and holding bitcoin as a strategic asset, similar to its historical use of gold as a reserve.

Also read: Why Is TRUMP Memecoin Crashing?

However, many analysts believe that the market has yet to fully account for the potential creation of a Strategic Bitcoin Reserve, even though bitcoin has reached over $109,000 in the past 24 hours.

Additionally, Polymarket’s data suggests that the likelihood of the incoming president signing at least one cryptocurrency-related executive order on his first day has dropped from over 50% to 37% in the past 24 hours.