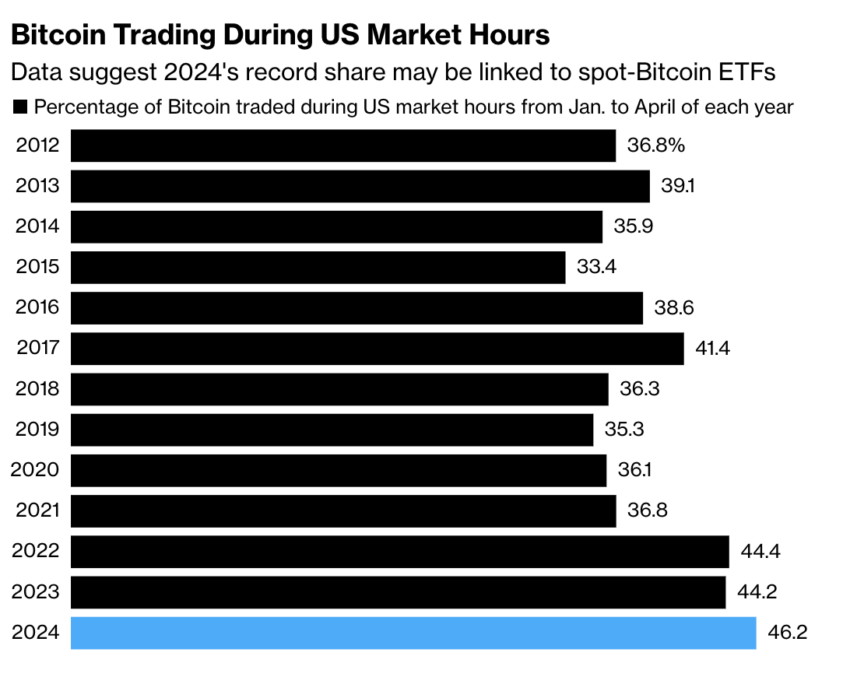

Spot-Bitcoin ETFs Drive Unprecedented Trading Volumes During US Hours

Bitcoin trading during US market hours has surged to unprecedented levels, accounting for 46% of this year’s cumulative volume from January to April.

This increase in trading activity is closely linked to the January launch of spot-Bitcoin exchange-traded funds (ETFs).

US Dominates Bitcoin Trading, Asia Lags Behind

Kaiko Research highlights that the volume of Bitcoin trading spikes at the beginning and close of US trading hours. This pattern correlates with the calculation of net asset values for the ETFs at the close of US stock exchanges each weekday.

Additionally, Thursdays see the highest share of trading during US hours, contributing nearly 15% of the cumulative daily volume.

While Bitcoin trading volume during US hours has rebounded to 2022 levels, volume during Asian trading hours remains significantly lower, Kaiko found. This shift indicates the growing influence of US market activities on Bitcoin trading dynamics.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Additionally, Toby Winterflood, Chief Product Officer of crypto data firm – CCData, noted that the performance of Bitcoin during US market hours reflects muted volatility compared to previous periods.

“That literally shows you the impact that these ETFs have had, not only on Bitcoin’s correlation with the S&P, but also its potential de-correlation with other altcoins and other cryptos,” Winterflood said.

The spot-Bitcoin ETFs have drawn nearly $13 billion in net inflows since their launch four months ago. This makes them one of the most successful product category debuts in industry history.

“Bitcoin and Ethereum Spot ETFs in the US are game changers because they can be held in tax-optimized wrappers. This significantly broadens access to the asset class in the world’s most financially important market,” Nicolas Streschinsky, Research and Development executive at Tezos Blockchain told BeInCrypto

Although demand has slowed, with a net $1.3 billion inflow so far in May, the pace seems to be picking up again. In the past two days alone, these ETFs have recorded a cumulative net flow of $542.9 million.

Currently, Bitcoin is trading around the psychological resistance level of $70,000. According to a report by Hashkey, Bitcoin returned five times the S&P 500 from January to April 2024.

Bitcoin, representing 53% of the entire crypto market cap, delivered a 57% return year-to-date. Whereas S&P 500 recorded 12.20% growth in the same period.

Read more: Bitcoin Price Prediction 2024/2025/2030

Bitcoin’s typically lower volatility compared to other crypto assets highlights its unique position within the market. Many other crypto assets have returned multiples of Bitcoin’s performance, reflecting the broader volatility and potential rewards within the crypto sector.

The post Spot-Bitcoin ETFs Drive Unprecedented Trading Volumes During US Hours appeared first on BeInCrypto.