Semler Scientific Plans $75M Fundraising to Boost Bitcoin Holdings

The post Semler Scientific Plans $75M Fundraising to Boost Bitcoin Holdings appeared first on Coinpedia Fintech News

Emboldened by the impressive success that Semler Scientific achieved in the fourth quarter of 2024 through its Bitcoin holdings in the form of an unrealised profit of $ 28.9 million, the public company has decided to raise at least $75 million to purchase more BTC tokens. This indicates that the company is following the footsteps of MicroStrategy, which called on top companies, like Microsoft, to consider its Bitcoin-dominated treasury strategy. Here is what you should know about the development.

Semler Scientific’s $75M Bitcoin Fundraising Plan

Semler Scientific is preparing to raise as much as $75 million. Reports suggest that a major portion of this fund will be utilised solely for purchasing Bitcoin. Reports indicate that the fund will be raised using convertible senior notes maturing in 2030.

Semler Scientific Bitcoin Holdings: An Overview

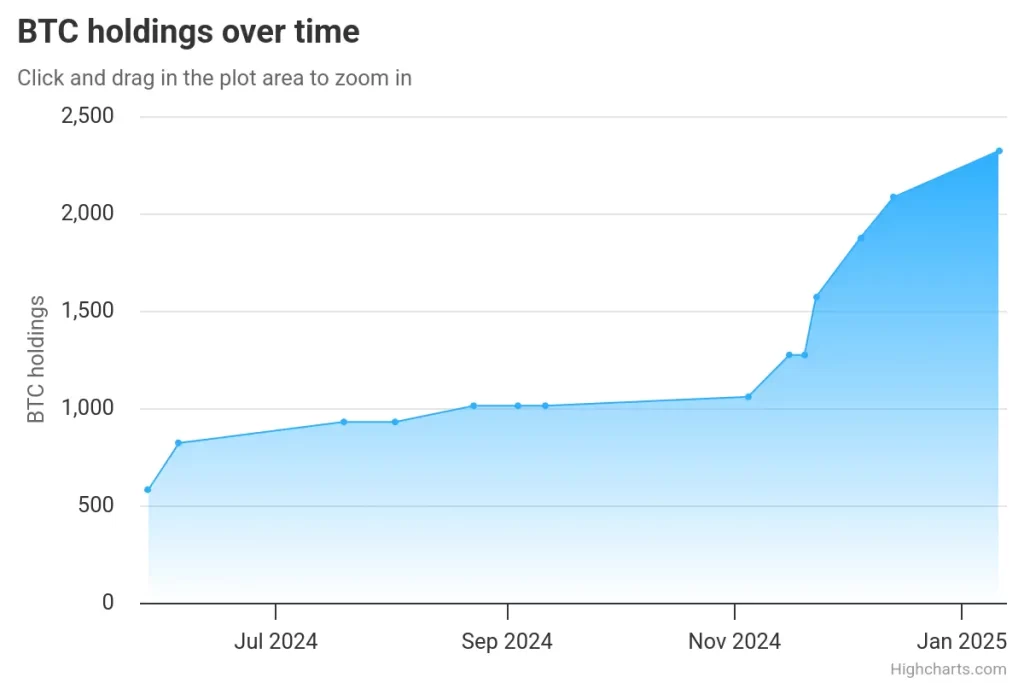

Right now, Semler Scientific holds at least 2,321 BTC tokens, valued at nearly $244,852,455.98. It is the twelfth largest public company in terms of BTC holdings.

In May 2024, the company’s total Bitcoin holdings stood at 581 BTC tokens. In August, it climbed to 1,012 BTC. By the end of the year 2024, the total holdings reached as high as 2,084.

On January 10, 2025, the company added at least 237 BTC to its BTC reserve, pushing its total BTC holdings to a peak of $2,321 BTC.

The company’s Q4 2024 earnings report shows that the company achieved at least $28.9 million in unrealised gains through its BTC holdings in the fourth quarter alone.

Semler Scientific’s Market Performance

In the fourth quarter of 2024, the Semler Scientific market recorded a growth of 106.427%. The year-to-date growth of the market in 2025 stands at 11%. Between January 6 and 13, the market dropped by nearly 21.79%. Since January 13, the market has surged by around 29.33%.

Semler Scientific’s Commitment to Bitcoin Strategy

Reports indicate that the top leadership of Semler Scientific is planning to go ahead with its aggressive Bitcoin treasury strategy.

In a recent statement,

Semler Scientific CEO Doug Murphy-Chutorian has expressed excitement about the company’s commitment to go ahead with the strategy.

Bitcoin’s Role in Corporate Treasury Strategies

Since the US election, the Bitcoin market has experienced a massive growth of 55.10%.

The public companies that follow an aggressive BTC treasury strategy have benefited immensely due to this market growth.

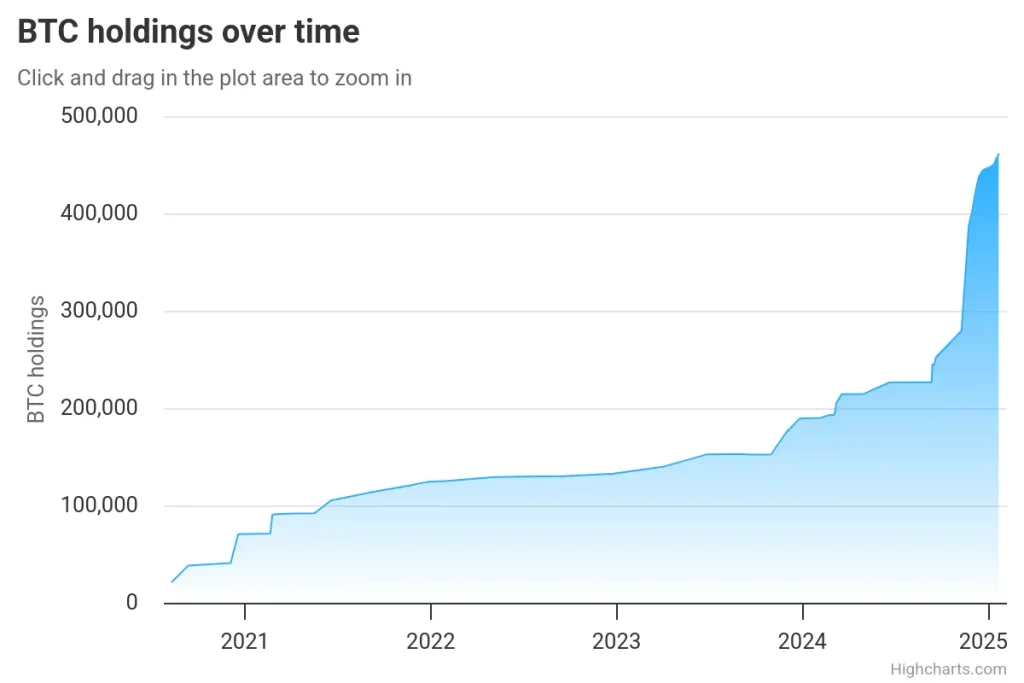

The best example is the success achieved by microstrategy

Business Intelligence

the public company that holds the highest number of BTC tokens. The MSTR BTC holdings now remain at over 461,000 BTC, worth at least $48,497,200,000.

Recently, MicroStrategy founder michael saylor

michael saylor

Michael J. Saylor is an enthusiastic blockchain influencer and a splendid leader. He is an entrepreneur and business executive who co-founded Microstrategy, he is chairman and CEO of the same Microstrategy. He is a vocal advocate of Bitcoin. He is highly skilled in enterprise software and also has a rich knowledge of numerous fields, including analytics, data warehouses, leadership, SaaS, management, cloud computing, startups, professional services, enterprise architecture, mobile devices, and many more.

Location: United States

Education :

He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Experience:

He has been an Executive Chairman & Founder at MicroStrategy from Aug 2022 – Present

He was also Chairman, CEO & Founder of MicroStrategy from Oct 1989 to Aug 2022

Skills: Buisness Intelligence and Data warehousing

Net Worth: Saylor’s net worth is about $4.6 billion, according to Forbes. He also held 2.4 million shares of MicroStrategy

Events Attended: Bitcoin 2024 Nashville and BTC prague

[email protected]

EntrepreneurCrypto and Blockchain ExpertAuthor

called on top companies to consider its Bitcoin treasury strategy, boasting about the massive gain the company achieved through the strategy.

In conclusion, Semler Scientific’s move to raise $75 million highlights its growing reliance on Bitcoin as a strategic asset. By joining other companies like MicroStrategy, Semler shows how cryptocurrency can play a vital role in corporate treasury strategies, especially during market surges. Its ambitious approach reaffirms Bitcoin’s potential to transform corporate finance.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.