Ethereum (ETH) Price Prediction for February 19, 2025

The post Ethereum (ETH) Price Prediction for February 19, 2025 appeared first on Coinpedia Fintech News

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised to continue its price drop due to the current market sentiment and bearish price action. Today, February 19, 2025, a 3.5% price drop in the past 24 hours has pushed Ether to a crucial level, where a slight further decline could bring the asset near the $2,000 mark.

Ethereum Price Action and Current Momentum

With a 3.5% price drop in the past 24 hours, ETH is currently trading near $2,620 and has been attracting notable interest from traders and investors, resulting in a 10% jump in trading volume.

According to expert technical analysis, ETH has been trading within a consolidation zone between $2,565 and $2,800 for the past two weeks. However, with the recent price drop, the asset has reached the lower boundary of this range, making it more vulnerable to further declines.

Based on recent price action and historical patterns, if ETH fails to hold this consolidation and falls below the $2,560 level, there is a strong possibility it could drop by 15% to reach $2,120 in the coming days. Otherwise, the price will likely continue to consolidate in the near term.

However, the sentiment remains bearish, and trading below the 200 Exponential Moving Average (EMA) confirms a downtrend.

Traders’ and Investors’ Mixed Sentiment

Despite this bearish outlook, investors and traders may be accumulating the token, as observed by the on-chain analytics firm Coinglass. Data from spot inflow/outflow reveals that exchanges have witnessed an outflow of over $68 million worth of ETH in the past 24 hours, indicating potential accumulation.

Experts and analysts see this outflow as a bullish sign, as it can create buying pressure and drive further upside momentum. However, this time, sentiment has shifted toward the bearish side.

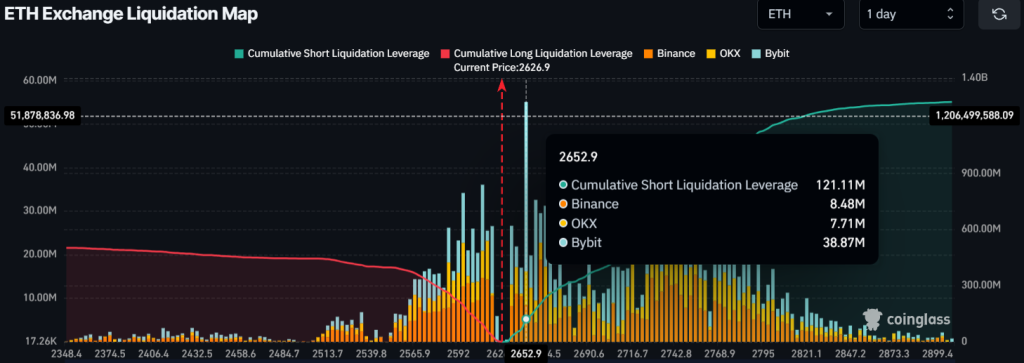

Meanwhile, intraday traders are focusing on the bearish side, as their bets have significantly increased. Data reveals that bears are over-leveraged at $2,650, holding $121 million worth of short positions. On the other hand, $2,605 is another key level where bulls are over-leveraged, holding over $90 million worth of long positions, lower than the short positions.

When combining this data, it appears that bears are dominating and are likely attempting to push the asset below the breakout level.