Bitcoin Bull Run Ahead? DXY Drop Signals 2017-Style Surge

The post Bitcoin Bull Run Ahead? DXY Drop Signals 2017-Style Surge appeared first on Coinpedia Fintech News

In the last three days, the US Dollar Index, or DXY, which measures the US dollar’s value against a basket of six major currencies, has dropped from above 107 to around 105. Meanwhile, in the last 24 hours, the Bitcoin price has showcased an impressive surge of 7.7%. There are reasons to assume that the present pattern may replicate a 2017 pattern – in which a drop in the value of the DXY index from 103 to 90 caused a massive bull run in the BTC market. Is a BTC bull run coming?

DXY Mirrors Trump’s First Term Pattern

Between late September 2024 and early January 2025, the value of the DXY index surged steeply from 100 to 110. However, since mid-January 2025, it has sharply plummeted from 110 to 105.

The DXY index measures the US dollar’s value against a basket of six major currencies, including the Euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

If any of these currencies strengthen against the dollar, the value of the DXY decreases.

This means that in the last three months, the US dollar has shown weakness against some of these currencies.

At the start of this year, one Euro was equivalent to 1.03551 Us dollar. Now, the value of a Euro is $1.06981 – at least 3.31% higher than at the beginning of the year.

This implies that the Euro has gained strength against the US dollar since the start of the year 2025.

Experts opine that the latest pattern, observed in the DXY index, looks similar to the pattern formed during the first term of US President Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

.

Bitcoin’s Price Responds to DXY Movements

The relationship between the DXY index and the crypto market is complex, but there are some general trends to observe.

Historically, there has often been an inverse correlation between the DXY and the price of Bitcoin. In 2017, when the DXY index slipped from 103 to 90, a massive bull run was triggered in the BTC market.

Importantly, a decrease in the DXY suggests that investors are more willing to take on risk.

The global tariff war, initiated by the US, targeting major global economies – specifically Canada, Mexico and China – has affected the macroeconomic environment of the US.

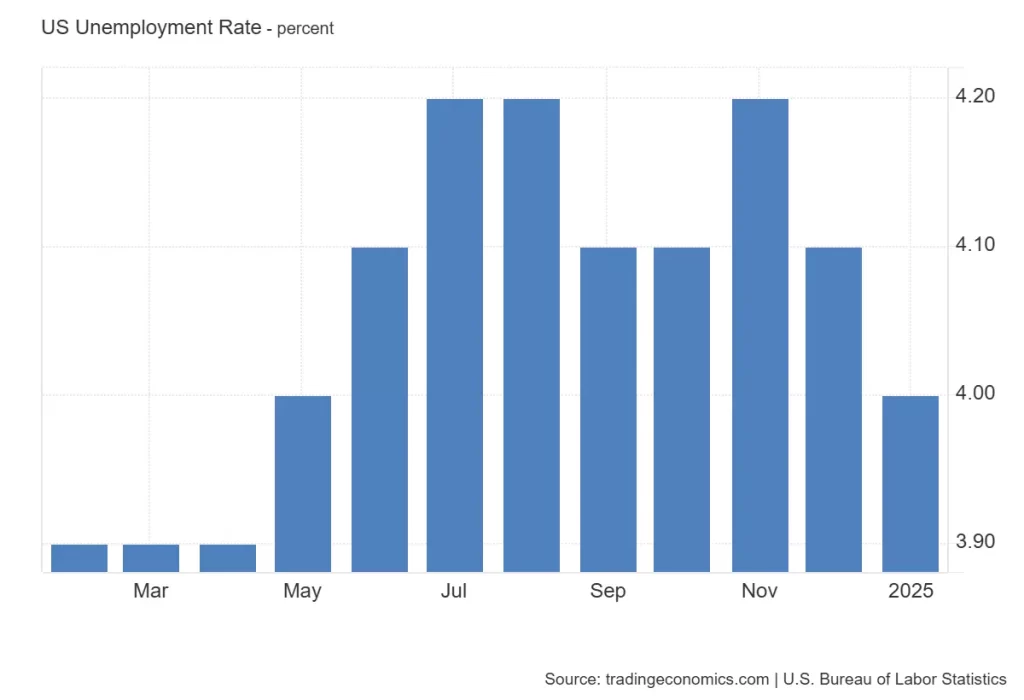

Certain major indexes are expected to face the heat of this economic uncertainty. In January, the US unemployment rate dropped from 4.1% to 4%. The consensus is that in February it will remain unchanged at 4%

Some investors view BTC as a hedge against inflation. A decrease in the DXY can strengthen this perception.

Notably, a weakening dollar can change the relative value of cryptos like BTC, as many crypto trading pairs are traded against the dollar.

In conclusion, with the DXY falling and Bitcoin surging, investors are watching economic data closely. The upcoming jobs report could determine the next move for both markets, with a potential Fed rate cut on the horizon.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.