Binance’s Bold Move: Investing Customer Funds in US Treasury Bills!

The post Binance’s Bold Move: Investing Customer Funds in US Treasury Bills! appeared first on Coinpedia Fintech News

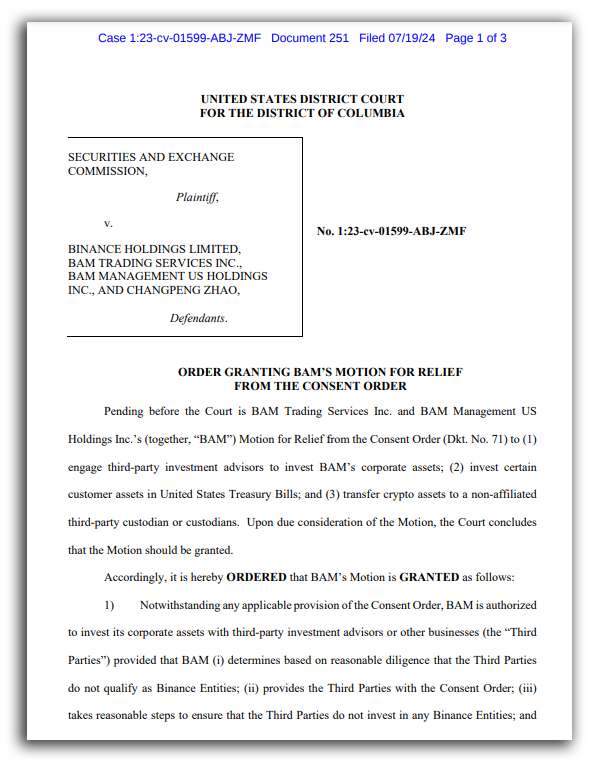

On July 19, a United States court granted Binance the approval to invest customer funds in US Treasury Bills. According to the order from the United States District Court for the District of Columbia, Binance can invest “certain” customer funds through a third-party investment manager. Binance must ensure that it does not invest these funds back into the company or any of its related entities.

What This Means for Binance and Its Customers

The court’s order stipulates that Binance must include any costs associated with maintaining the custodied US Treasury investments in its monthly business expense reports. Binance must also detail these costs in its operation reports. This move could signal cryptocurrency’s potential role in supporting the US dollar amid de-dollarization efforts by BRICS nations. Experts suggest using collateralized stablecoins to extend US dollar dominance by buying and holding US debt instruments. This approach could help offset the massive inflation caused by years of poor monetary and fiscal policies.

The Role of Stablecoins

Tether’s USDT stablecoin is a prime example. In 2023, Tether held $72.5 billion in US Treasuries, rivaling the holdings of certain developing nations. Tether emphasizes the overcollateralization of its dollar-pegged stablecoin as a safeguard against major market collapses. Former US House Speaker Paul Ryan highlighted how stablecoins can address the debt crisis. He also noted that stablecoins help keep the US dollar competitive in global trade markets. These instruments back the value of the fiat-equivalent tokens.

Judicial Approval Details

Earlier this week, Binance requested court approval to invest about $40 million in $10 million increments over four weeks. Judge Amy Berman Jackson approved this request, allowing the exchange to invest its customer fiat funds in US Treasury Bills.

The trading account on TreasuryDirect will handle these investments, and they will mature on a rolling four-week basis. Binance must maintain enough funds on its platform to meet all expected customer withdrawal requests. It must also update its terms of use to notify customers about this new investment strategy.

Key Conditions and Compliance

The court granted Binance several other requests, including the authorization to engage third-party investment advisors to manage its corporate assets. Binance can also transfer its custodied assets to a non-affiliated third-party custodian in the United States. The judge emphasized that Binance must control the new private and administrative keys for these wallets solely through its US employees or the third-party custodian.

Legal and Strategic Implications

The US Securities and Exchange Commission (SEC) is currently in an ongoing legal battle with Binance US, the subsidiary of the global Binance exchange. Despite these challenges, the court’s approval allows Binance to diversify its investments and enhance safety and returns for its users. Investing in US Treasury Bills provides liquidity and a predictable return, making it an ideal option for preserving capital while earning modest interest.

Looking Forward

This move not only strengthens Binance’s financial strategy but also sets a precedent for other cryptocurrency exchanges. By maintaining transparency and compliance with legal requirements, Binance aims to build trust and ensure the security of its customers’ assets. As the crypto market continues to evolve, such strategic decisions will play a crucial role in shaping the future of digital finance.