Hong Kong’s HK Asia Holdings Surge 103% After Bitcoin Investment

The post Hong Kong’s HK Asia Holdings Surge 103% After Bitcoin Investment appeared first on Coinpedia Fintech News

Hong Kong-based HK Asia Holdings Limited has officially joined the growing list of public companies investing in Bitcoin—and the decision is already paying off. Since purchasing its first BTC on February 16, the company’s stock price has surged 103.13%.

Have you ever seen an investment strategy pay off that fast? Read on for more details.

HK Asia Increases Bitcoin Holdings

On February 16, HK Asia made its first Bitcoin purchase, buying 1 BTC. A few days later, on February 20, the company added 7.88 more BTC, bringing its total holdings to 8.88 BTC.

Even though this is a relatively small investment compared to industry giants, the impact on HK Asia’s stock has been remarkable.

Before the Bitcoin purchase, HK Asia’s stock was trading at 3.19 HKD. On February 17, the first trading day after the acquisition, the stock jumped 72.1% in a single day. Since then, it has continued to rise, reaching 6.50 HKD, marking a 103.13% gain.

Could HK Asia’s Stock Hit a New High?

At the start of 2024, HK Asia’s stock was priced at just 0.295 HKD. Since then, it has soared 2,137.29%, with a 290.07% increase recorded between February 13 and 17 alone.

The stock has now surpassed its June 2019 all-time high (ATH) of 6.50 HKD. If the price holds, analysts believe the company could close above this key level.

Yesterday, HK Asia’s stock closed at 6.30 HKD, after hitting an intraday high of 7.18 HKD. However, it currently remains 2.94% below today’s opening price.

Why is HK Asia Buying Bitcoin?

On February 23, HK Asia’s board of directors formally approved its Bitcoin investment strategy, following the trend of publicly traded companies using BTC to increase earnings and diversify assets.

The sharp rise in HK Asia’s stock price after its initial Bitcoin purchase may have influenced the board’s decision to commit to a more aggressive BTC strategy.

Following MicroStrategy’s Playbook?

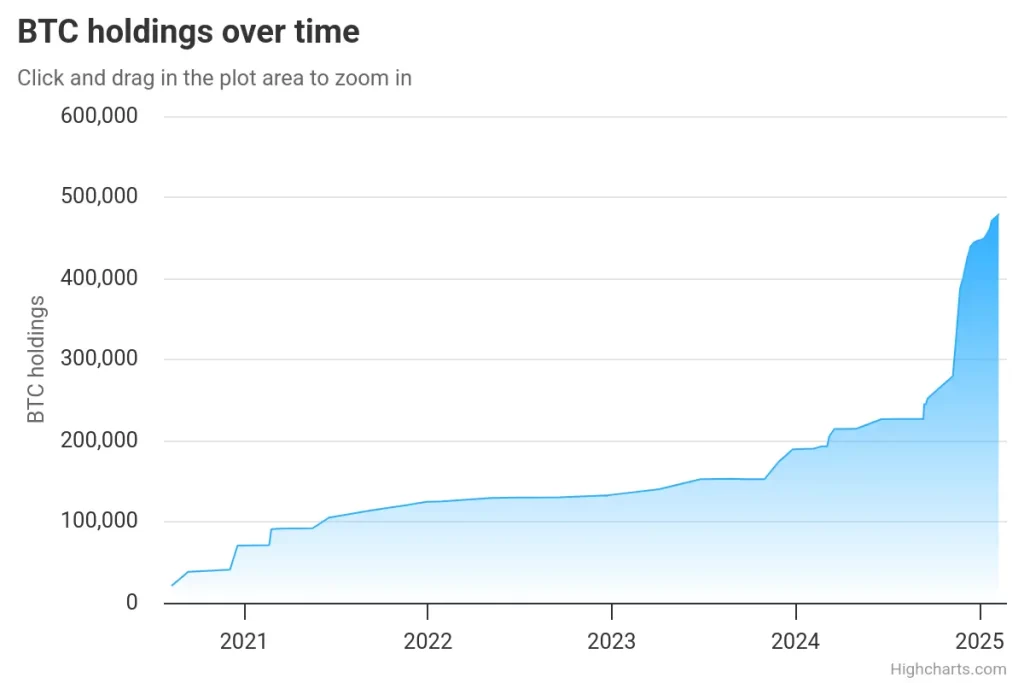

Strategy (MSTR), the largest public holder of Bitcoin, has been a strong advocate for corporate BTC investment. Late last year, the company encouraged major firms like Microsoft to follow suit.

Currently, Strategy holds 478,740 BTC, worth about $45.76 billion. While HK Asia’s holdings are much smaller, its stock performance shows that even a modest BTC investment can drive significant market impact.

With Bitcoin on its balance sheet, HK Asia is now riding the same wave as some of the biggest names in the industry.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.