Traders Prepare for Volatility with $3.4 Billion in Bitcoin and Ethereum Options Expiring Today

Crypto markets will witness $3.42 billion in Bitcoin and Ethereum options contracts expire today. The massive expiration could cause a short-term price impact, particularly as markets wait expectantly for Bitcoin to tag $100,000.

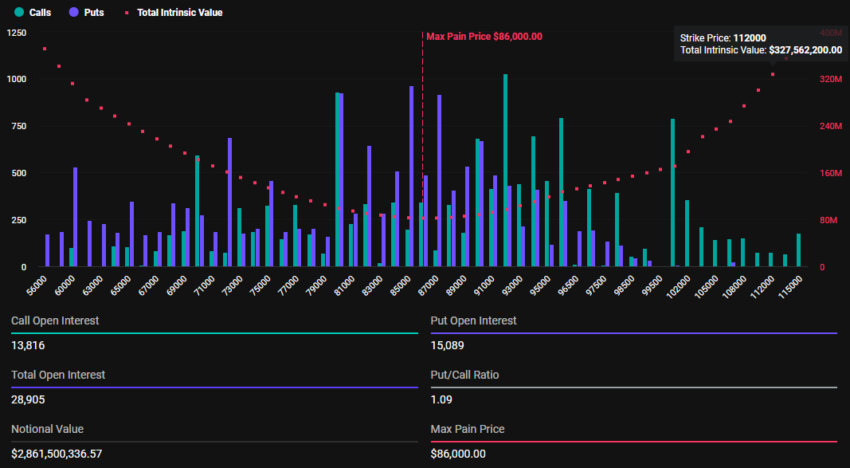

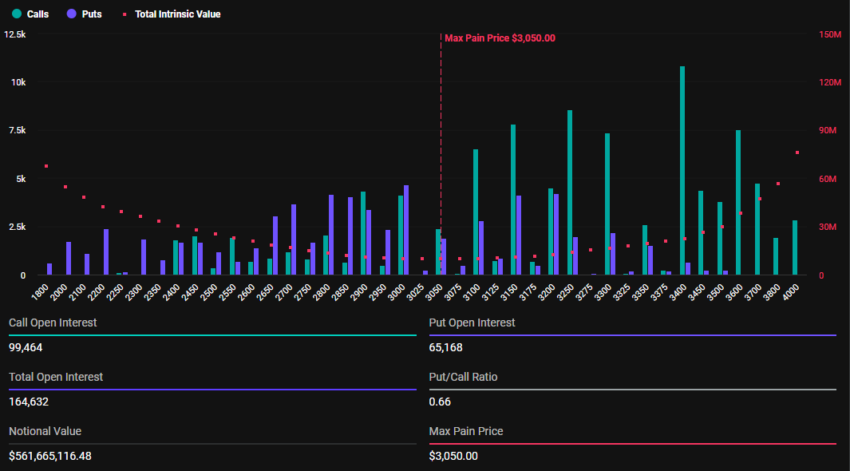

With Bitcoin options valued at $2.86 billion and Ethereum at $561.66 million, traders are bracing for potential volatility.

Unlike Ethereum, Traders Bet On Bitcoin Price Pullback

There has been a significant increase in Bitcoin (BTC) and Ethereum (ETH) contracts due for expiry today compared to last week. According to Deribit data, 28,905 Bitcoin options contracts will expire on Friday with a put-to-call ratio of 1.09 and a maximum pain point of $86,000.

On the other hand, 164,687 Ethereum contracts are due for expiry today, with a put-to-call ratio of 0.66 and a maximum pain point of $3,050.

Bitcoin’s Put-to-call ratio stands above 1, indicating a generally bearish sentiment despite BTC’s whales and long-term holders fueling its recent growth. In comparison, Ethereum counterparts have a put-to-call ratio of 0.66, reflecting a generally bullish market outlook.

The put-to-call ratio gauges market sentiment. Put options represent bets on price declines, whereas call options point to bets on price increases.

When this ratio is above 1, it suggests a lack of optimism in the market, with more traders betting on price decreases. On the other hand, a put-to-call ratio below 1 suggests optimism in the market, and more traders are betting on price increases.

Bitcoin’s Put-to-Call Ratio, Implications for BTC

As options near expiration, traders are betting on BTC prices dropping and ETH prices rising. According to the Max Pain Theory in options trading, BTC and ETH could each pull toward their maximum pain points (strike prices) of $86,000 and $3,050, respectively. Here, the largest number of contracts — both calls and puts — would expire worthless.

Notably, price pressure for both assets will ease after Deribit settles contracts at 08:00 UTC today. At the time of writing, however, BTC was trading for $98,876, whereas ETH was exchanging hands for $3,389. Meanwhile, in line with put-to-call ratios, analysts at Greeks.live anticipate an extended move north for ETH and say BTC is at the cusp of a correction.

“With about 8% of positions expiring this week, the big rally in Ethereum has led to a significant increase in ETH major term options IV [implied volatility], while BTC major term options IV has remained relatively stable. The market sentiment remains extremely optimistic at this point,” Greeks.live analysts said.

The analysts also note that while Bitcoin risks a correction, the generalized market rally keeps this potential pullback at bay. They ascribe the positive sentiment in the market to significant capital inflows into ETFs (exchange-traded funds), specifically BlackRock’s IBIT options, which started to trade only recently alongside a strongly driven spot bull market.

Nevertheless, with today’s high-volume expiration, traders should anticipate fluctuations in Bitcoin and Ethereum prices that could shape their short-term trends.

The post Traders Prepare for Volatility with $3.4 Billion in Bitcoin and Ethereum Options Expiring Today appeared first on BeInCrypto.