What Are the Top Passive Income Crypto Strategies To Generate Wealth In 2024: Staking, Liquidity Pool or Masternodes?

For the most extended period of their launch, trading and investing were the only ways to generate profits in crypto. Each comes up with its own pros and cons and varied rewards accordingly. Initially, most people kept their distance from the digital asset class due to its volatile nature. However, as the market evolved, it grew stable and brought new models to generate income. Methods like Staking, yield farming, lending or mining of cryptocurrencies emerged in the past few years and garnered massive popularity among users.

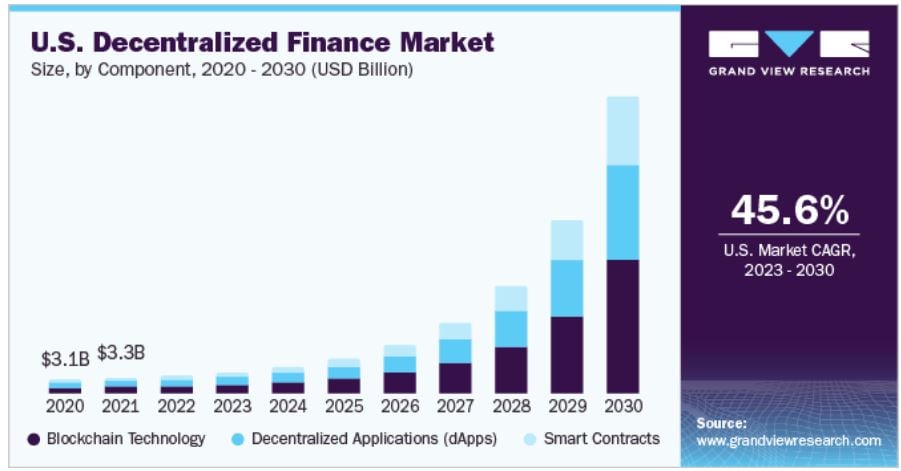

The decentralized finance (DeFi) market is growing at a rampant pace despite how the market performs. The crypto market moves in bearish and bullish cycles, but the DeFi sector is seen making constant and impressive growth. Research shows that the global decentralized finance market, which was valued at USD 13.61 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 46.0% from 2023 to 2030, reaching an estimated market size of USD 213.5 billion by 2030.

Source: Grandviewresearch

Let’s discuss all three methods of crypto staking, lending, and running masternodes to understand which has the upper hand and can provide better returns to investors or users in 2024.

Crypto Staking—Staking involves locking cryptocurrencies in a wallet to support the operations of a blockchain network. It is akin to depositing money in a savings account but with higher potential returns. Typically, staking yields vary from 5% to 20% APY, depending on the blockchain protocol. For instance, Cosmos ($ATOM) provides 17%, and Filecoin ($FILE) gives 16.3%.

While staking provides a relatively stable income stream and enhances network security, it lacks liquidity as the staked assets are locked and cannot be traded or sold quickly.

Liquidity Pool: A liquidity pool is a collection of funds locked in a smart contract used to facilitate decentralized trading, lending, and other functions. Users, known as liquidity providers, add an equal value of two tokens to a pool, enabling others to trade between these tokens. In return, providers earn transaction fees based on their share of the pool, potentially offering a significant return on investment (ROI).

This model benefits investors by providing passive income from trading fees and sometimes additional rewards in the form of governance tokens, thus increasing the potential ROI depending on the volume and liquidity of the pool.

Masternodes: Running Masternodes represents a fusion of staking and yields farming benefits, with the added element of supporting network operations beyond transaction verification, such as executing smart contracts and participating in governance decisions.

Masternodes require a substantial initial investment and a permanent stake in the network to enhance network integrity and stability. The returns on masternodes can be very attractive, often outpacing those of simple staking and with less risk than yield farming.

Running Masternodes on Different Platforms:

Morpheus.Network ($MNW)

Morpheus.Network provides an illustrative example of the benefits of running masternodes, particularly in a blockchain environment that transcends mere transactional capabilities to address real-world supply chain challenges.

The network offers a significant 18% APR on masternodes, a competitive rate with the best yield farming returns without the associated risks. This high yield reflects not only the network’s profitability but also its stability and the critical role that masternodes play in its ecosystem.

A node operator on Morpheus.Network requires a stake of 900 $MNW tokens to operate a masternode, keeping the network secure and efficient. There’s a cap of 10 nodes on the number of masternodes one operator can run to ensure decentralization.

The strategic relevance of Morpheus.Network is underlined by its partnerships with global tech leaders like Google and Microsoft, and its adoption by major industry players such as Coca-Cola and Gulftainer. These collaborations and client engagements enhance the network’s credibility and suggest a stable demand for its services, which supports the sustainability of the returns from its masternodes.

Dash ($DASH)

A Bitcoin fork, Dash Network ($DASH) introduced masternodes to the blockchain focusing on enhancing transaction speed and privacy. It requires 1000 $DASH tokens as collateral to run masternodes that govern and secure the network. In return, node operators can earn up to 45% of block rewards.

Dash’s implementation in Venezuela showcases its potential as an alternative currency during economic crises, providing instant, private transactions through its masternode network. This has led to widespread adoption among Venezuelan merchants, offering a stable transaction method amidst hyperinflation.

Pivx ($PIVX)

Pivx, derived from Dash, emphasizes masternodes for enhanced transaction security and speed. To operate a masternode, one needs 10,000 PIVX coins and the official wallet. Masternodes in Pivx not only secure and authenticate the network but also enjoy voting rights and a share of network fees, contributing to network governance.

The privacy feature of Pivx’s masternodes is especially beneficial for businesses requiring confidential transactions, helping protect sensitive financial information and ensuring customer privacy, although specific impact data on businesses is limited.

| Platform | Token Requirement | Masternode Limit | Yield | Main Features | Network Role | Strategic Relevance | Risk & Management |

| Morpheus.Network | 900 $MNW | Cap of 10 nodes per operator | 18% APR on masternodes | High yield with less volatility, contributes to network security and efficiency | Secures and efficiently manages real-world supply chain challenges | Partnerships with major tech and industry players like Google, Microsoft, Coca-Cola, and Gulftainer enhance credibility | Less volatile than crypto mining, requires less active management |

| Dash Network | 1000 $DASH | No specified cap | Up to 45% of block rewards | Enhances transaction speed and privacy, contributes to governance | Provides instant, private transactions and acts as an alternative currency during economic crises | Widespread adoption among Venezuelan merchants, demonstrating utility in unstable economic environments | Requires active management but provides consistent returns compared to mining |

| Pivx | 10,000 $PIVX | No specified cap | Share of network fees | Enhances transaction security and speed, contributes to governance | Secures transactions and offers confidentiality for business operations | Focuses on privacy, catering to businesses needing confidential transactions | Requires active management, potentially lower risk compared to mining due to consistent returns from network fees |

Final Thoughts

In conclusion, crypto staking and yield farming offer valid avenues for generating passive income and running masternodes, especially on platforms like Morpheus.Network offers a superior balance of high returns, security, and contribution to the blockchain ecosystem.

Investors looking for a sustainable and relatively safe method to earn from their crypto investments should consider the substantial benefits of running masternodes, backed by solid business applications and strategic industry partnerships that ensure long-term viability and stability.